Data Story: South Sudan’s External Borrowing since 2017

An overview of South Sudan’s external public debt from the International Monetary Fund, World Bank, China Exim Bank, Qatar National Bank and the Afreximbank from 2017 to date

By Okot Emmanuel

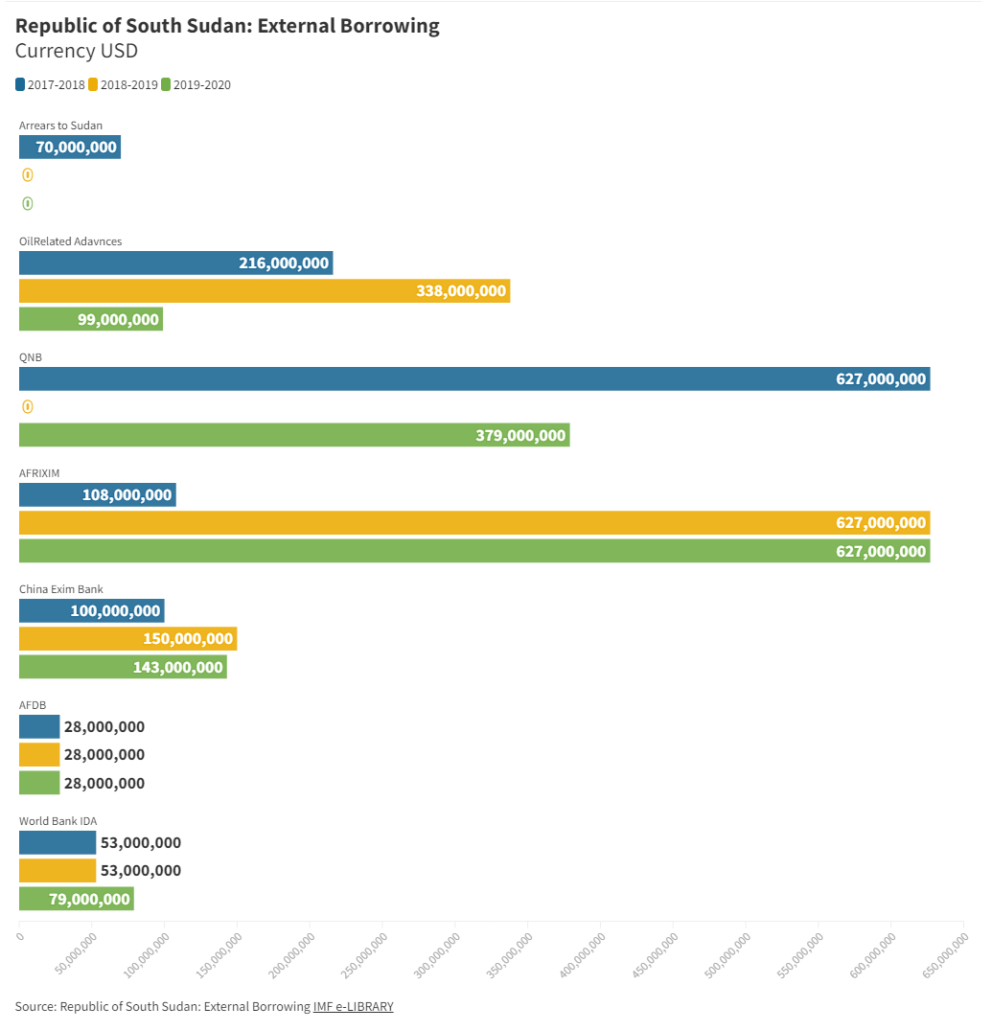

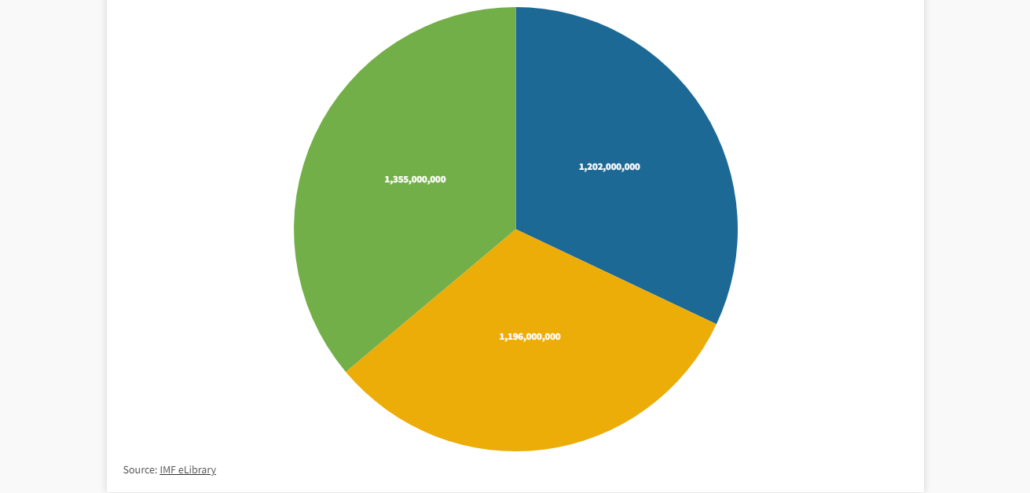

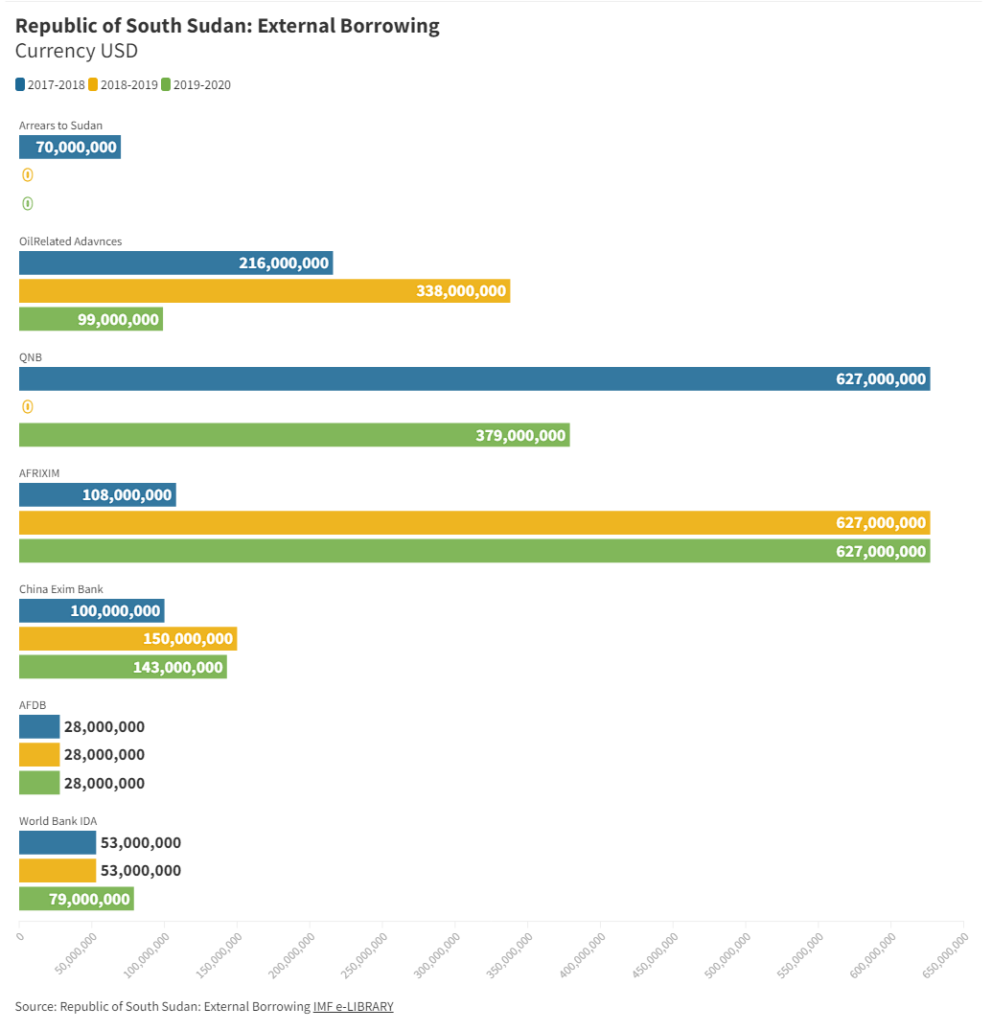

According to the IMF, South Sudan’s external public debt was estimated at US$1,355 million (41 percent of GDP) as of end-June 2020.

Debt to the World Bank amounted to US$79 million on IDA terms, while debt to the African Development Bank (AfDB) amounted to US$28 million.

US$150 million had been borrowed from China Exim Bank to upgrade the Juba International Airport.

Debt to the QNB amounted to US$627 million. Oil-related short-term loans have declined significantly, from an estimated US$338 million in March 2019 to US$99 million in June 2020.

In FY19/20 around 81 percent of total loans (46 percent: QNB loans; 35 percent: oil advances and Afreximbank loans) are highly non-concessional.

South Sudan has not requested to participate in the Debt Service Suspension Initiative.

In 2019 South Sudan public debt was 1,281 million Euros (approximately 1, 434 million dollars), a decrease of 724 million since 2018. This amount means that the debt in 2019 reached 31.26% of South Sudan GDP, a 15.04 percentage point fall from 2018, when it was 46.3% of GDP.

Slightly higher oil production and faster oil-price recovery relative to the projections in the 2020 DSA have modestly improved South Sudan’s debt-servicing capacity.

The latest oil production data from the authorities show slightly higher oil production of about 170 barrels per day (bpd) in February 2021 compared to the about 165 bpd for the same period assumed in the 2020 DSA.

The latest WEO also projects higher oil prices in 2021 and the next few years; the projected average Brent oil prices for 2021 and 2022 are 58.5 and 54.8, respectively in the February 2021 WEO compared to 43.8 and 45.6, respectively, in October 2020 WEO.

As more than 90 percent of total exports and government revenue come from oil, these positive oil-sector developments improved South Sudan’s debt-servicing capacity.

Okot Emmanuel, a Data Speaks Fellow at #defyhatenow South Sudan, wrote this data story, which was edited by 211 Check Editor Emmanuel Bida Thomas and approved for publication by Steve Topua, Data Analyst and Trainer. It’s part of the ongoing #defyhatenow South Sudan Data Speaks Fellowship program with funding from the European Union Delegation to South Sudan.

About South Sudan Data Speaks Fellowship:

This is a two-month and half data journalism fellowship for South Sudanese content creators with an aim of educating participants on the fundamentals of data journalism through in-depth training facilitated by experienced data analysts.

The fellows have been selected from across South Sudan and they are trained in data sourcing/mining, data analysis, and data visualization for two months and half (October to Mid December)

Each fellow will produce a minimum of three (03) data stories during the fellowship. The focus will be on increasing access to information

211 Check

211 Check