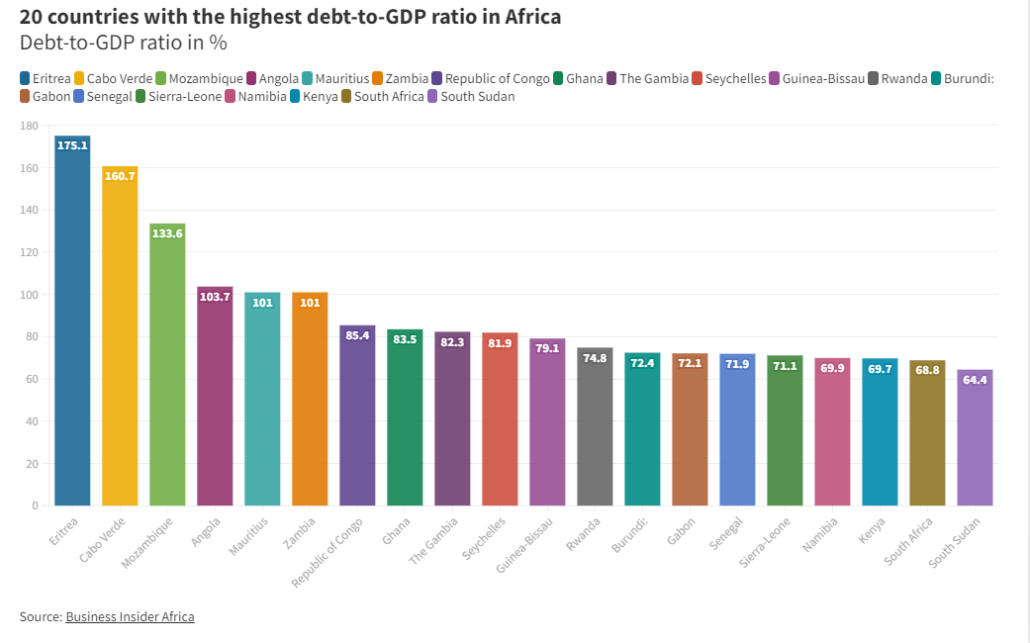

Business Insider Africa estimates South Sudan’s debt-to-gross domestic product ratio at 64.4%

By comparing what a country owes with what it produces, the debt-to-GDP ratio reliably indicates that particular country’s ability to pay back its debts. Often expressed as a percentage, this ratio can also be interpreted as the number of years needed to pay back debt if GDP is dedicated entirely to debt repayment

By Okot Emmanuel

Business Insider Africa has listed South Sudan among twenty countries with the highest debt-to-gross domestic product ratio in the continent.

It says South Sudan has a debt-to-GDP ratio of 64.4% as of 2022.

The debt-to-GDP ratio is the metric comparing a country’s public debt to its gross domestic product.

The Business Insider says by comparing what a country owes with what it produces, the debt-to-GDP ratio reliably indicates that particular country’s ability to pay back its debts.

That said, below are 20 African countries with the highest debt-to-GDP ratios. This list is courtesy of a report by Statista dated December 2021. Although the exact figures of these countries’ public debts were not disclosed, the percentage of debt to GDP is clearly indicated as you can see below.

| Country | Debt-to-GDP ratio |

| Eritrea | 175.10% |

| Cabo Verde | 160.7%. |

| Mozambique | 133.60% |

| Angola | 103.70% |

| Mauritius | 101% |

| Zambia | 101% |

| Republic of Congo | 85.40% |

| Ghana | 83.50% |

| The Gambia | 82.30% |

| Seychelles | 81.90% |

| Guinea-Bissau | 79.10% |

| Rwanda | 74.80% |

| Burundi: | 72.40% |

| Gabon | 72.10% |

| Senegal | 71.90% |

| Sierra-Leone | 71.10% |

| Namibia | 69.90% |

| Kenya | 69.70% |

| South Africa | 68.80% |

| South Sudan | 64.40% |

A recent report by the World Bank showed that more than half of the world’s low-income countries, most of which are in Africa, are either currently struggling with debt distress or at risk of doing so.

The international financial institution says 15 low-income countries today have debt that is collateralized by natural resources—yet none provide details on the collateral arrangements.

The World Bank then stressed that greater debt transparency makes it easier for governments to make informed decisions about future borrowings.

In the same vein, it makes it easier for the citizens to hold their leaders accountable for the loans borrowed.

Also, Standard Bank Group recently red-flagged Ghana, Kenya Ethiopia, Zambia and Angola as African countries that could soon experience serious debt risks.

Although the exact figures of these countries’ public debts were not disclosed, The Business Insider Africa recommends that countries should take serious issues of debt.

About the Authors:

Okot Emmanuel, a Data Speaks Fellow at #defyhatenow South Sudan, wrote this data story, which was edited by 211 Check Editor Emmanuel Bida Thomas and approved for publication by Steve Topua, a Data Analyst and Trainer. It’s part of the ongoing #defyhatenow South Sudan Data Speaks Fellowship program with funding from the European Union Delegation to South Sudan.

About South Sudan Data Speaks Fellowship:

This is a three months data journalism fellowship for South Sudanese content creators with an aim of educating participants on the fundamentals of data journalism through in-depth training facilitated by experienced data analysts.

The fellows have been selected from across South Sudan and they are trained in data sourcing/mining, data analysis, and data visualisation for three months (October to December)

Each fellow will produce a minimum of three (03) data stories during the fellowship. The focus will be on increasing access to information