South Sudanese Pound’s Rollercoaster Ride: Analyzing its exchange rate journey against the Dominant American Dollar

This comprehensive analysis explores the history and determinants of the South Sudanese Pound’s exchange rate against the American Dollar, providing insights into its fluctuations and implications for the country’s economy.

Author: Stephen Topua

Introduction:

Currency exchange rates play a crucial role in international trade and financial markets, reflecting the value of one currency to another. This data story delves into the history of the South Sudanese Pound (SSP) and its exchange rate fluctuations against the mighty American Dollar (USD) since its introduction in 2012. We aim to provide valuable insights into the evolving relationship between the SSP and USD, shedding light on the factors influencing their exchange rate dynamics by analysing this trend over the past ten years.

South Sudan, a young nation that gained independence in 2011, introduced its national currency, the South Sudanese Pound, to establish its economic identity. Since then, the exchange rate between the SSP and USD has been a critical measure of the country’s financial performance and stability.

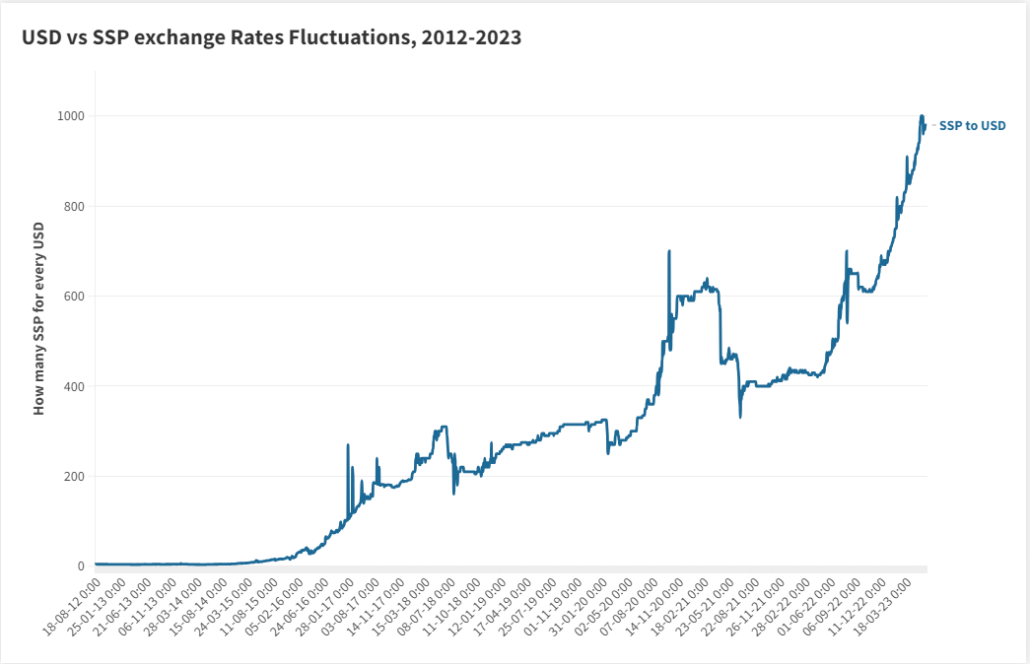

We use this trend to give a perspective of how this relationship has evolved over the last ten years until the present moment when the SSP is trading for over 900 for every USD.

Background:

Exchange rate: the exchange rate represents the price of a national currency valued as a foreign currency. When the exchange rate for a currency rises so that the currency exchanges for more of other currencies, it is referred to as appreciating or “strengthening.” When the exchange rate for a currency falls so that it trades for less than other currencies, it is referred to as depreciating or “weakening.

How are exchange rates determined?

Exchange rates, which reflect the value of a country’s currency to other currencies, are influenced by various factors. Inflation, interest rates, public debt, political stability, and economic health all play crucial roles in shaping the strength or weakness of a currency. Countries with low inflation rates and stable political environments tend to have stronger currencies, as they attract investors and inspire confidence. Additionally, a robust economy, positive balance of trade, and low current account deficits contribute to a currency’s appreciation. However, speculative activities and short-term market sentiments can also affect exchange rates.

Understanding these determinants helps in analyzing and predicting currency movements. Knowledge of these factors is vital for businesses, investors, and policymakers in making informed decisions in the global financial markets. It is important to monitor inflation rates, as low inflation tends to support stronger currencies. Interest rates influence the attractiveness of a currency to investors, and higher rates can strengthen exchange rates. Public debt levels, political stability, and economic health also impact exchange rates. Finally, trade balance and current account deficits affect a country’s currency value. By considering these determinants, stakeholders can navigate the complex world of foreign exchange and adjust their strategies accordingly.

Types of exchange rate systems:

There are four main types of exchange rate regimes. The first is the free-floating system, where exchange rates fluctuate constantly based on market demand and supply. Currency prices change dynamically, reflecting the forces of the foreign exchange market.

The remaining three types include fixed, pegged, and managed float systems. In the fixed system, a monetary authority sets a firm exchange rate for the currency to a foreign currency or a basket of currencies. This fixed rate remains constant over time. Under the pegged system, a country ties the value of its currency to a foreign currency or a specific unit of account. Although bilateral parity is maintained, the value of the home currency fluctuates in line with the anchor country’s currency. In the managed float system, the exchange rate is influenced by both market conditions and interventions by the monetary authority. The central bank actively participates in the foreign exchange market to manage and steer the exchange rate without committing to a predetermined path.

Understanding these various exchange rate systems is crucial for comprehending the dynamics of international trade and financial markets. Each system offers different degrees of flexibility and control over a country’s currency value, shaping economic outcomes and policy decisions.

The United States of America vs South Sudan Economies by Comparison:

The GDP is the market value of all final goods and services produced within a country in a given period. For comparison purposes, The GDP of both the USA and South Sudan are:

- USA: 26.24 trillion USD

- South Sudan: 7.02 Billion USD

Evolution in the exchange rate of the South Sudanese Pounds (SSP) versus the United States Dollars (USD)

At the inception, the exchange rate was SSP 2.75 for every 1 USD. However, things quickly went downhill as the exchange rate is currently at 980 SSP for every 1 USD within years, peaking at 1001 SSP for every USD. This is highlighted by the graphs below.:

The first graph shows how the exchange rates have evolved between 2012 and 2023, offering the highs and lows in the process. The second graph displays daily changes in the exchange rates, showing drastic daily changes in the process, such as the highest daily exchange rate, highest gain and highest loss in value by the SSP on the United States dollar.

The link to the visualisation is Here.

The link to the visualisation showing the daily difference in the exchange rate is given Here

Some insights emerge from the data, which we highlight below:

- The most significant loss in value for the SSP against the USD was between 12 and 13 October 2020, when it went from 515 to 700 in a matter of 24 hours

- The biggest gain in value for the SSP against the USD was between 13 and 14 October 2020 and between 6 and 7 August 2022, when it went from 700 to 550 in a matter of 24 hours

- The highest-ever exchange rate was on 24 May 2023, when it stood at 1001 SSP for every USD

How do search terms related to Exchange rates compare in South Sudan for the past 12 months?

In conclusion, we compare how searches are compared for four related topics: South Sudanese pound, USD, BoSS, exchange rate and FOREX. For this segment, we use Google Trends for the data collection and visualisation. Google Trends is a website by Google that analyzes the popularity of search queries in Google Search across various regions and languages. The website uses graphs to compare the search volume of different questions over time. We use this feature to analyse how the search patterns of the four topics emerge from July 2022 to June 2023.

The graph below shows interest over the past 12 months. The research shows that USD is consistently the most searched term, indicating considerable interest in USD in the country. All the data was collected using GoogleTrends.

The graph below shows that the USD generated the most interest in the period lasting 12 months, followed by Exchange Rate. In contrast, BoSS and the SSP showed little interest in search volumes in the analysed period.

NB: the data was visualised using Datawrapper.

This comprehensive analysis explores the South Sudanese Pound’s history and its exchange rate fluctuations against the American Dollar over the past decade. Factors influencing exchange rates, such as inflation, interest rates, public debt, political stability, economic health, balance of trade, and confidence/speculation, are discussed. The four main types of exchange rate regimes—freely floating, fixed, pegged, and managed float—are explained, highlighting their characteristics and implications. The article emphasizes the importance of understanding these determinants and exchange rate systems for businesses, investors, and policymakers to make informed decisions in the global financial markets. We also examined search trends related to exchange rates in South Sudan, indicating significant interest in the United States Dollar while providing valuable insights into the complex dynamics of exchange rates and their impact on economies.

To ensure accuracy and transparency, we at 211 Check welcome corrections from our readers. If you spot an error in this article, please request a correction using this form. Our team will review your request and make the necessary corrections immediately, if any.