Explainer: New US tariffs hit South Sudan: What you need to know

Writer: Makur Majeng

The United States has announced new tariffs on goods imported from several African countries, including South Sudan. A 10% tariff will now apply to goods coming from South Sudan into the U.S., as part of a broader move by President Donald Trump to impose “reciprocal tariffs” globally.

This explainer breaks down what tariffs are, why they matter, and how they could impact South Sudan and the wider East African region.

What is a tariff?

A tariff is a tax imposed by a government on goods imported from other countries. Tariffs make imported products more expensive, aiming to encourage consumers to buy local alternatives or to protect domestic industries from foreign competition.

Why is the U.S. imposing new tariffs?

The 2025 tariffs are part of Trump’s push for “reciprocal tariffs” — arguing that U.S. goods face higher taxes abroad and that America should respond similarly. A full list published by The Guardian shows new tariffs applied on countries including China (34%), Vietnam (46%), India (26%), and South Africa (30%). However, the U.S paused tariffs for other countries to allow room for negotiation, but increased tariffs on goods from China by 125% after the Chinese government retaliated by imposing 84% on American goods.

For African nations, the tariffs are framed as a response to “currency manipulation, trade barriers, and unfair competition” — although many experts say the measures could hurt developing economies more than they help U.S. industry.

How does this impact South Sudan?

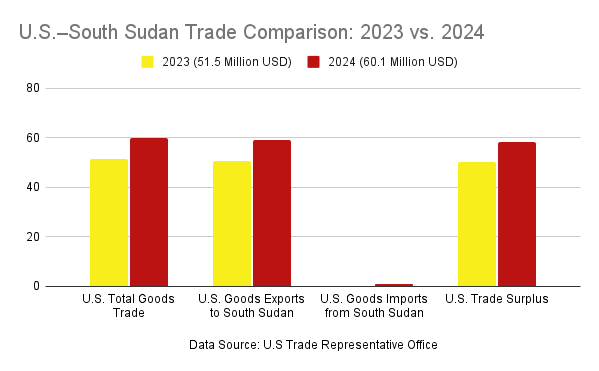

South Sudan is only a minor trade partner for the United States. According to the United States Trade Representative (USTR), in 2024, the total U.S. goods traded with South Sudan was $60.1 million. The U.S. goods exports to South Sudan were $59.3 million, a 16.9% increase from 2023.

However, U.S. goods imports from South Sudan were just $0.8 million, though this rose 165.3% from 2023, and the U.S. had a $58.5 million trade surplus with South Sudan in 2024.

Because South Sudan’s exports to the U.S. are very small, the direct financial impact of the new 10% tariff will likely be limited. However, the broader signal — that African countries are not exempt from global tariff wars — could discourage future trade growth.

Additionally, if U.S. businesses importing goods like raw materials or specialty products from South Sudan pass on the extra costs to consumers, South Sudanese exporters could face difficulties maintaining competitiveness.

Although the dollar amounts are modest, the tariff could discourage future trade growth. For example, if a South Sudanese leather handbag used to sell in the US for $100, it will now cost $110 after the 10% tariff, making it harder to compete with products from countries without such taxes.

Local products like oil and gum arabic, looking to expand exports, may now face higher barriers to entry into the American markets.

Which other East African countries are affected?

South Sudan is not alone, but other affected East African countries include the Democratic Republic of Congo (DRC), Kenya, Ethiopia, Uganda, Djibouti, and Eritrea. Each faces new tariff rates ranging from 10% to 30%, depending on the product category.

Is there a remedy for the tariff?

Countries impacted by tariffs have several options:

- Negotiate bilateral trade deals with the U.S. to seek exemptions or reductions.

- Diversify export markets beyond the U.S. to reduce reliance.

- Invest in value-added production, which could offset tariff costs by exporting finished goods rather than raw materials.

For South Sudan, which is still building its trade capacity post-independence, regional partnerships and improving its ease of doing business could be key strategies.

Looking ahead

While the immediate economic hit to South Sudan might be small, the broader risk is reduced access to the U.S. markets in the future. As global trade becomes increasingly protectionist, smaller economies like South Sudan must prepare for a more competitive and challenging international trade environment.

To ensure accuracy and transparency, we at 211 Check welcome corrections from our readers. If you spot an error in this article, please request a correction using this form. Our team will review your request and make the necessary corrections immediately, if any.

It’s vital to fight misinformation and disinformation in the media by avoiding fake news. Don’t share content you’re uncertain about. False information can harm and mislead people, risking their lives—Fact-check before sharing. For more details, visit https://211check.org/, or message us on WhatsApp at +211 921 350 435. #FactsMatter.

211 Check Website Graphic Feature

211 Check Website Graphic Feature

211 Check Website Graphics

211 Check Website Graphics

Leave a Reply

Want to join the discussion?Feel free to contribute!