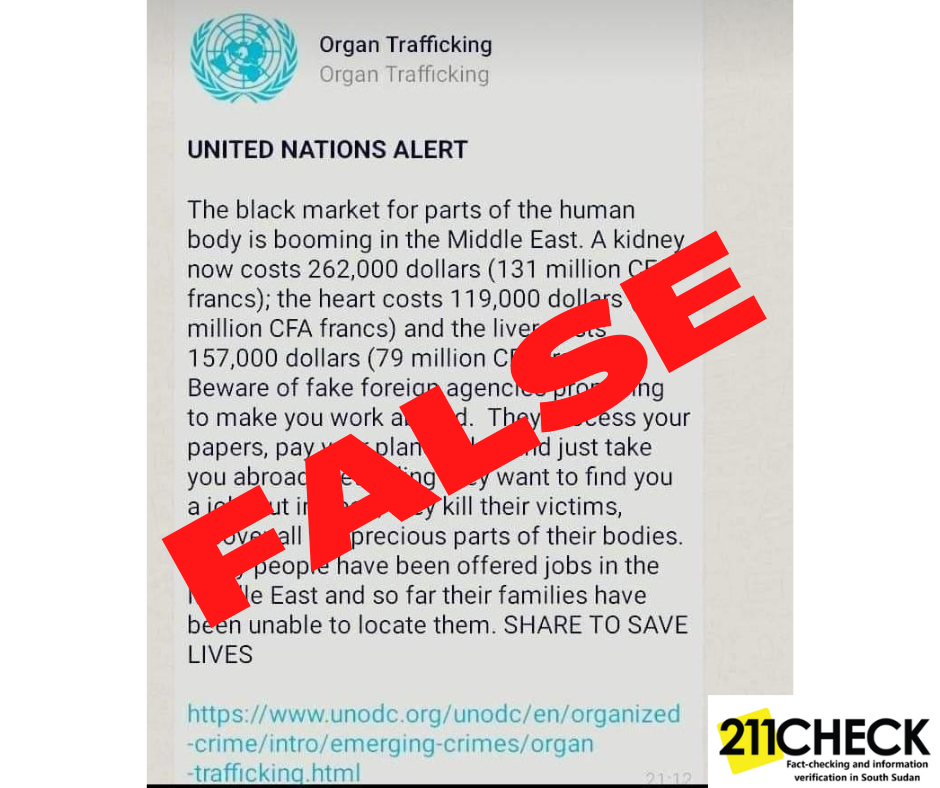

Fact-check: Has the UN issued an alert on organ trafficking? No, it’s fake

This alert is not available on the official website of the United Nations Office on Drugs and Crime. The United Nations denies having issued it.

By Ochaya Jackson

A United Nations document alerting the public on organ trafficking in the Middle East countries on social media is not true.

The document indicated that the black market for human body parts in Middle East is in high demand, and warned the public of fake jobs offer abroad in which they murder the victims and remove organs from their bodies to be sold in the black market.

“The black market for parts of the human body is booming in the Middle East. A kidney now costs 262,000 dollars (131 million CFA Francs); the heart costs 119,000 dollars (60 million CFA Francs) and liver costs 157,000 dollars (79 million CFA Francs). Beware of the fake foreign agencies promising to make you work abroad. They process your paper, pay your plane ticket, and just take you abroad pretending they want to find you a job, but instead, they kill their victims, recover all the precious parts of their bodies”, the document reads.

The document bears the claimed link to the website of the United Nations Office on Drugs and Crime.

When one clicks on the link claimed in the document, it returns an error message “the page or document requested is not available”.

Additionally, there is no any related document alerting about organ trafficking on the UN office on drugs and crime website.

A fact-check by PesaCheck in March 2021 on the same document found out that the alert was false.

Furthermore, the archived statement on organ trafficking on the website of UNODC covering from 2017 until August 2022 said that the need for transplantation of healthy organs into those who have failed organs have increased as such illicit means are being used to harvest human organs.

On March 10, 2021, UNODC Pakistan spokesperson Rizwana Asad told AFP that the claim was false and not shared by the UN.

AFP Fact-check states that the purported alert was first published on Facebook on March 2, 2021.

211 Check investigated an alleged United Nations alert warning the public about organ trafficking in the Middle East and discovered it to be FALSE.